23+ Builders risk insurance

Parties listed on the policy are insured against damages or losses such as a fire storms hail lightning high winds. The COVID-19 pandemic may affect one or more categories of loss under a New.

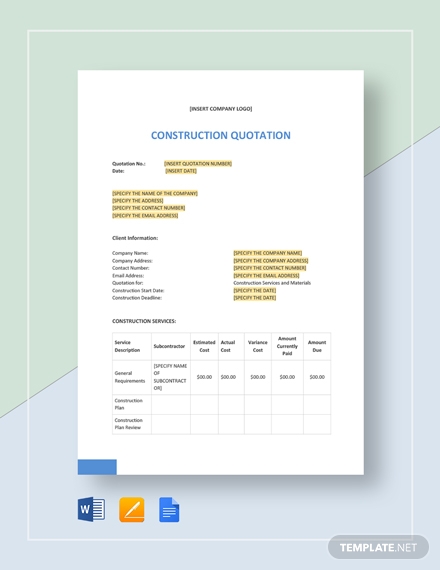

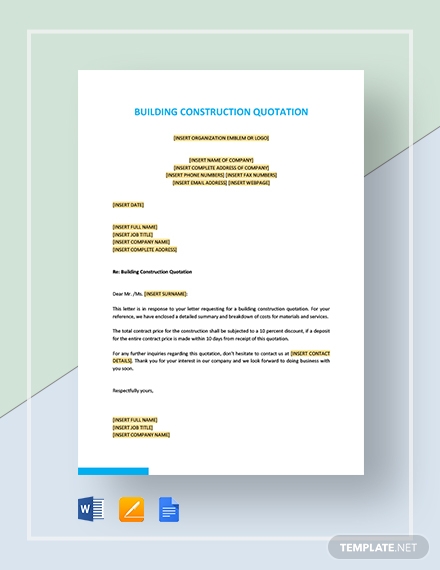

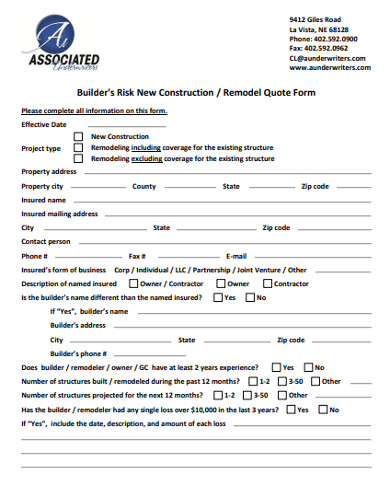

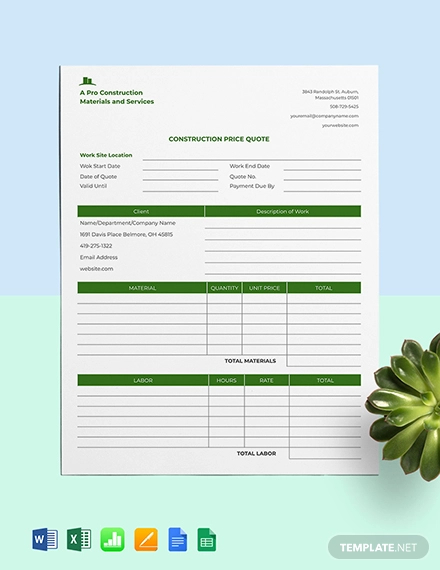

Construction Quote 9 Examples Format Pdf Examples

Most policies include coverage for hard costs soft costs and labor among other things.

. Projects of 50 million and above are processed through a Zurich-assigned broker. Get Free Quotes Save Now. The average cost of builders risk insurance is 1 to 5 of the total construction budget.

Typically these are the risks that a builders risk insurance policy will protect against. The policy starts on the effective date and ends when the project is completed and ready for occupancy. Wilshire Center Insurance Services has been delivering peace of mind with quality competitive insurance products to individuals and businesses every day since 1986.

Builders risk insurance is a unique insurance policy that covers buildings during construction or renovation. Most property and builders risk policies require a loss which is often defined as physical damage that is the result of a certain cause of loss to trigger coverage. The two most popular terms for Owner-Builder insurance contracts are Course of Construction and Builders Risk.

For example a 100000 construction budget with a three-month builders risk coverage may cost between 1000 and 5000 for the 3. Ad Get Insurance Built for Construction Businesses Online For As Little As 1895Month. December 23 2014 Planning.

These insurance contracts basically cover the materials and parties involved in the home building project which can include you architects lenders subcontractors and any physical materials. Several factors may affect your builders risk insurance quote. There are a few policies in the construction context that are most likely to provide insurance coverage for a shutdown of a construction project based on COVID-19.

This policy is built for the course of construction for a new project. The Hartfords builders risk insurance offers up a wide array of benefits and flexible options for construction and contracting businesses of all sizes. It is a good idea to choose coverage limits that are equal to the estimated costs of construction.

California Builders Risk Insurance is a specialized type of property insurance designed for buildings under construction. Find Your Plans Today. Two important differences between builders risk insurance and homeowners insurance are as follows.

Costs of Builders Risk Insurance vary widely based on the type of project location construction costs and construction type including materials and construction shape. Zurich is a leading provider of Builders Risk coverage for mid-sized to large construction projects ranging in size from 50 million and greater in total construction values. If your construction project is damaged by weather events such as wind lightning rain or hail builders risk insurance will provide coverage.

They cover most events unless they are specifically excluded. Projects valued up to USD 75 million can be submitted by any broker. A standard homeowners policy only covers finished structures on the property and their contents.

Builders risk insurance is also a type of construction insurance as it covers damage to the portion of the project that is already completed while the construction project is in progress. If paid annually then the cost is 1200 or 18000. For instance if your building project costs a total of 100000 expect to pay anywhere from 100 or 1500 a month.

The median cost of builders risk insurance is typically 95 a month according to Insureon. Builders risk insurance is an insurance policy that covers property and construction materials including tools and equipment during the construction phase. You have already got a four-month builders risk insurance policy so you have to pay any amount between 350 to 1900 monthly in premiums.

Our builders risk and heavy equipment coverage is designed to meet the unique needs of property owners and contractors whether they are working on offices schools roads medical facilities. New Construction Builders Risk Insurance policies cover a wide range of losses for construction projects. Wilshire Center Insurance Services Offers General Contractor Liability Construction Defect Builders Risk and Owner Protective Liability.

California Builders risk insurance is an. Premiums often range between 1 and 4 of the project cost with a 500000 project potentially costing between 5000 and 20000 in an annual premium. Builders risk insurance is a type of property insurance but it differs from the homeowners insurance you are probably more familiar with.

For example your team has decided on a construction budget of 150000. Home Insurance in Los Angeles. The main difference from simple property insurance is that builders risk policy covers the construction projects entirety from the beginning to the end.

Ad Compare 10 Best Home Insurance from Builders Risk Policy More. In general builders risk insurance is an insurance plan covering every building and commercial or residential structure built or renovated during a particular project. Builders risk insurance generally costs 1 to 5 of a companys entire building expenditure.

What Does Builders Risk Insurance Cover. Just Instant Affordable Coverage That Measures Up To Any Risk. Ad Protect your business through the Progressive Advantage Business Program.

The average builders risk insurance quote costs between 1 to 5 of the total construction budget. However if you want protection for more severe damage related to natural disasters. No Fine Print or Surprises.

Farmer Brown Home Facebook

What Is Builder S Risk Insurance Homeowners Insurance Homeowner Insurance

Farmer Brown Home Facebook

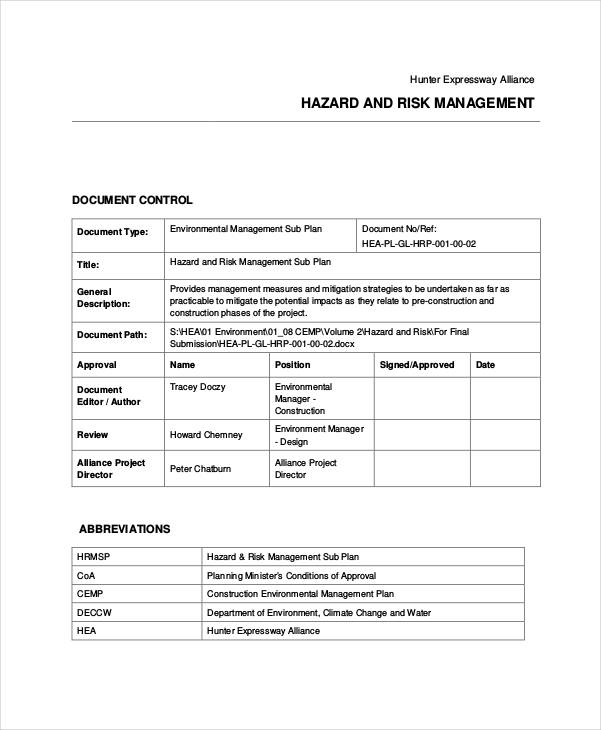

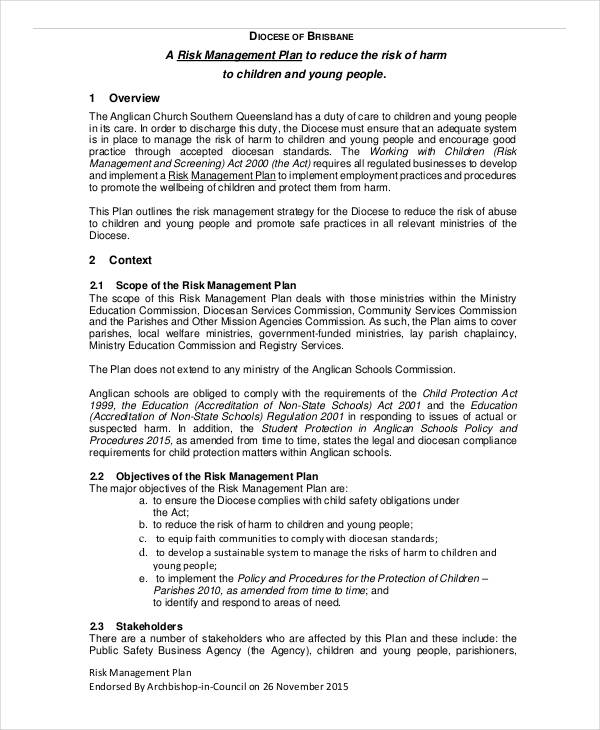

Risk Plan 31 Examples Format Pdf Examples

Akshargroup Twitter Search Twitter

Construction Quote 9 Examples Format Pdf Examples

Construction Quote 9 Examples Format Pdf Examples

Construction Quote 9 Examples Format Pdf Examples

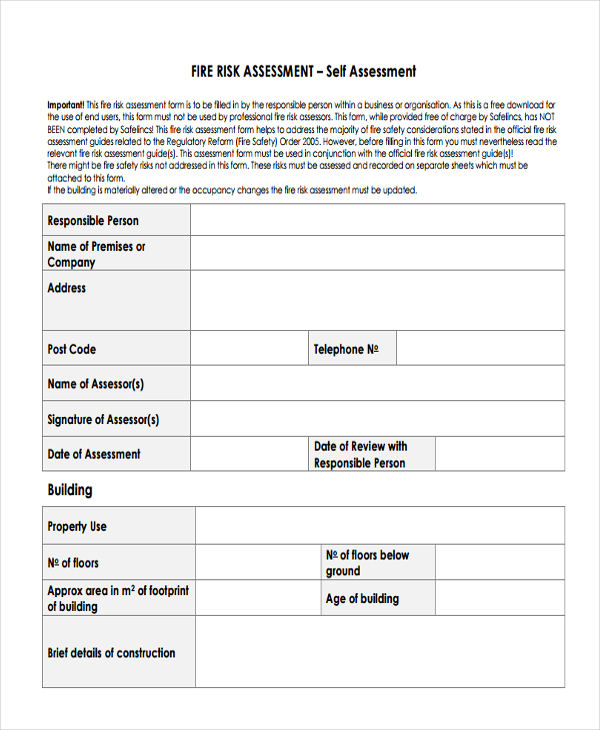

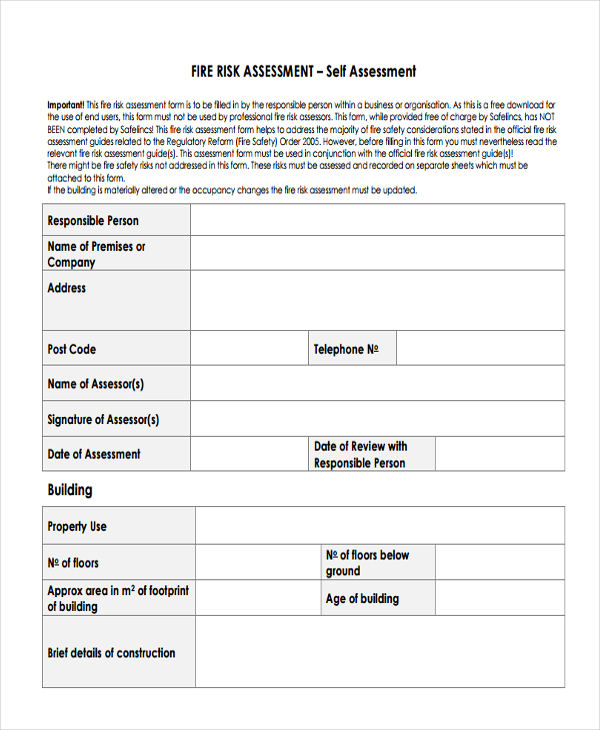

23 Risk Assessment Form Examples Free Premium Templates

Permission To Occupy Builders Risk Property Coverage Mistakes Home Insurance Quotes Being A Landlord Homeowners Insurance

Risk Plan 31 Examples Format Pdf Examples

Farmer Brown Home Facebook

Pin By Ascendore On Risk Management Infographics Risk Management Health Insurance Benefits Business Leadership

Farmer Brown Home Facebook

Farmer Brown Home Facebook

Farmer Brown Home Facebook

Free Psd Top View Engineering Tools With Clipboard Mock Up